Technical Tip

The Other Side of this journal entry is automatically posted to the Bank account being reconciled.

Use this option to prepare and post a journal entry, e.g. a direct debit for leases on the bank statement, in the Bank Reconciliation screen.

|

|

|

Technical Tip The Other Side of this journal entry is automatically posted to the Bank account being reconciled. |

Refer to "Selecting the Bank Account to Reconcile".

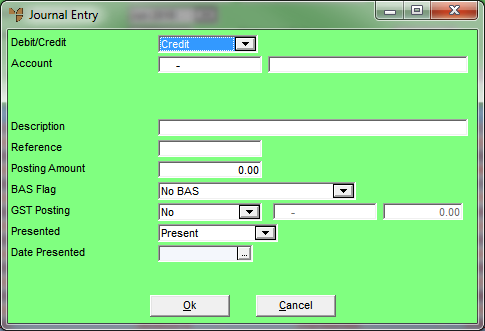

Micronet displays the Journal Entry screen.

|

|

Field |

Value |

|

|

Debit/Credit |

Select whether the journal entry is a credit or a debit. |

|

|

Account |

Enter the expense account to post the charges to, or press Enter to select an account. |

|

|

T1 Account, T2 Account |

If T accounts are enabled in your system, enter the T1 and T2 accounts associated with the journal entry. These override the default T1 and T2 accounts set in your company configuration (refer to "Configuring T Accounts"). |

|

|

T3, T4, T5 |

If T accounts are enabled in your system, enter the required T accounts. |

|

|

Description |

Enter a description of the journal entry, e.g. "Direct debit for leases". |

|

|

Reference |

Enter any reference for this journal entry. For example, you could enter the bank statement number or the date. |

|

|

Posting Amount |

Enter the amount of the journal entry. |

|

|

BAS Flag |

Micronet displays the BAS flag entered against the selected expense account. However, you can change this if required to process the transaction with an alternative BAS section, e.g. to G14- No GST. |

|

|

GST Posting |

Select whether GST is applicable to the journal amount. Options are:

The other side of this journal entry is automatically posted to the Bank account being reconciled. |

| Presented | Select whether the journal entry should be presented or unpresented on the Bank Reconciliation. | |

| Date Presented | Enter or select the date the transaction was presented. |

Micronet redisplays the Bank Reconciliation screen with the journal entry added to the bottom of the transaction list.